As the video I posted states we have become obsessed with one metric, totally ignoring every other disease and issue faced by the human race. It's mass hysteria and we are going to suffer long and hard for it. As usual though the ones who will suffer most are the ones least placed to bear it, the lower classes.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Social distancing, .. what's that?

- Thread starter transatlantic

- Start date

Help Support UKworkshop.co.uk:

This site may earn a commission from merchant affiliate

links, including eBay, Amazon, and others.

- Status

- Not open for further replies.

artie

Sawdust manufacturer.

How many people died that day of flu, heart disease, Alzheimer's or cancer?I would call it a significant increase over the second of September (3 deaths)

Lets get some perspective.

How many people died that day of flu, heart disease, Alzheimer's or cancer?

Lets get some perspective.

If I recall correctly around this time of year the daily death rate is about 1200 people (all causes). In the depths of winter that goes up to over 2000 a day and in the summer it falls to under 1000. (The average across the year is around 1700 per day, but of course that varies a lot depending on the season)

Even 100 people a day dying with C19 is small potatoes at this time of year, especially as a good proportion of them would have died from something else anyway.

Remember again, these deaths are WITH C19, not necessarily FROM C19 and indeed the daily death figures are running along at exactly what we would expect for this time of year, no massive increase at all.

Cabinetman

Established Member

Very rough figures and I mean very rough, population of 66 million average life expectancy 84 means that 785,714 people die every year which is 2152 and a bit a day. I’ve said almost from the start that we are totally out of proportion on this virus. Maybe the original lockdown had some merit to ease the NHS into this – till we found out what it was all about but the present lockdowns are in my view ridiculous, it should be possible to protect the vulnerable from the worst of this and let the rest of us just get on with it. Ian

Trainee neophyte

Established Member

Everyone has rather forgotten that the financial system was failing, and had actually started to implode in September 2019. If you wear your tinfoil hat at a rakish angle, you can come up with theories that explain most of the covid19 rationale as being nothing to do with saving lives, and everything to do with allowing a controlled demolition of the world economy.

It doesn't actually matter, at the end if the day, if it was planned or just happened organically: the system is still going to fail. There is another thread running at the moment about inflation: if you define inflation as a rise in prices, then there is some, but not too much (ignore the official statistics - from the same people who include prostitution and drugs in gdp numbers, purely to avoid admitting to an endless recession). However, if you define inflation as an increase in the money supply then inflation is stratospheric and about to go interstellar. This may or may not affect the prices of things we buy in the next few months, but it is certainly going to cost us all in the long run.

When "they" proudly announce a Universal Basic Income, it will be time to run for the hills.

It doesn't actually matter, at the end if the day, if it was planned or just happened organically: the system is still going to fail. There is another thread running at the moment about inflation: if you define inflation as a rise in prices, then there is some, but not too much (ignore the official statistics - from the same people who include prostitution and drugs in gdp numbers, purely to avoid admitting to an endless recession). However, if you define inflation as an increase in the money supply then inflation is stratospheric and about to go interstellar. This may or may not affect the prices of things we buy in the next few months, but it is certainly going to cost us all in the long run.

When "they" proudly announce a Universal Basic Income, it will be time to run for the hills.

doctor Bob

Established Member

- Joined

- 22 Jun 2011

- Messages

- 5,171

- Reaction score

- 1,882

240000 what?

Could be f*** ups in woodworking, would make sense with people finding it as a new hobby in 2020.

I made one back in 2011 .............................

Could be f*** ups in woodworking, would make sense with people finding it as a new hobby in 2020.

I made one back in 2011 .............................

£13.99 (£2.80 / count)

VEVOX® FFP1 Dust Mask - Set of 5 - Valved Face Masks - Respirator - Protection e.g. for Construction, Building Work, Sanding, Woodworking, Fine Dusts, Aersoles or Particles

SLSK Ventures GmbH (UK)

£12.50 (£1.25 / count)

£14.45 (£1.44 / count)

JSP M632 FFP3moulded Disposable Dustmask (Box of 10) One Size suitable for Construction, DIY, Industrial, Sanding, dust protection 99 Percent particle filtration Conforms and Complies to EN 149

Amazon.co.uk

£17.99 (£1.80 / count)

£27.44 (£2.74 / count)

3M 8822 Disposable-fine dust mask FFP2 (10-pack)

Amazon.co.uk

£19.31 (£3.86 / count)

£19.99 (£4.00 / count)

Stealth Lite Pro FFP3 Face Masks UK Certified Dust Mask. 99.99% particle filtration, air filter reusable face mask. FFP3 Mask -7 day use per Construction, Woodworking, DIY and Welding Mask

Amazon.co.uk

Trainee neophyte

Established Member

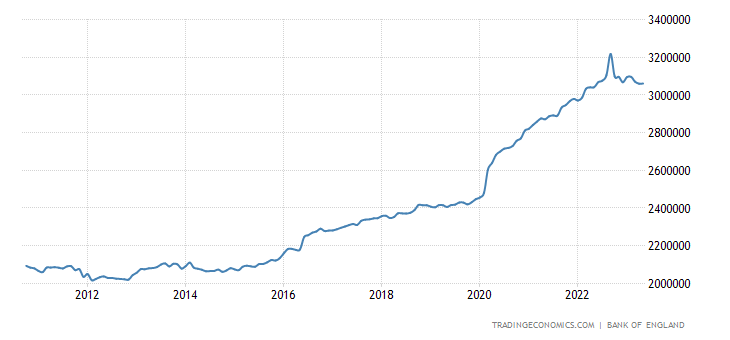

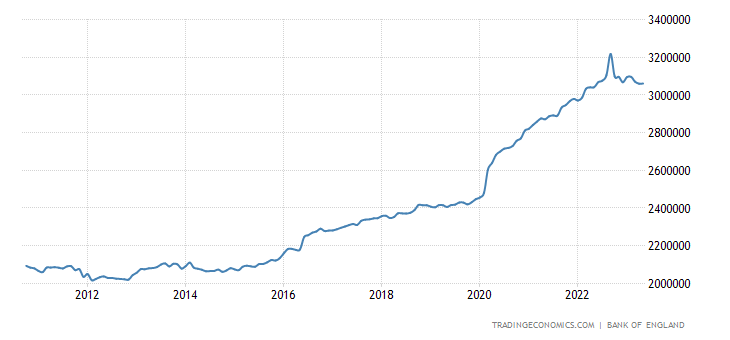

Millions, I expect. The link is United Kingdom Money Supply M2 | 1986-2020 Data | 2021-2022 Forecast | Historical240000 what?

"Money Supply M2 in the United Kingdom decreased to 2713066 GBP Million in August from 2713963 GBP Million in July of 2020"

https://www.labnol.org/internet/visualize-numbers-how-big-is-trillion-dollars/7814/

artie

Sawdust manufacturer.

Where did the 897 million go?"Money Supply M2 in the United Kingdom decreased to 2713066 GBP Million in August from 2713963 GBP Million in July of 2020"

doctor Bob

Established Member

- Joined

- 22 Jun 2011

- Messages

- 5,171

- Reaction score

- 1,882

Where did the 897 million go?

Shhhhhhhhh ............. keep quite and stop making a fuss and I'll split it with you.

Trainee neophyte

Established Member

"A million here, a million there - soon you're talking real money".Where did the 897 million go?

artie

Sawdust manufacturer.

"A million here, a million there - soon you're talking real money".

Shhhhhhhhh ............. keep quite and stop making a fuss and I'll split it with you.

No seriously, how does the money supply decrease?

RobinBHM

Established Member

Very rough figures and I mean very rough, population of 66 million average life expectancy 84 means that 785,714 people die every year which is 2152 and a bit a day. I’ve said almost from the start that we are totally out of proportion on this virus. Maybe the original lockdown had some merit to ease the NHS into this – till we found out what it was all about but the present lockdowns are in my view ridiculous, it should be possible to protect the vulnerable from the worst of this and let the rest of us just get on with it. Ian

It would if this country had effective test and trace in place.

In which case we could then be protecting the vulnerable.

RobinBHM

Established Member

If I recall correctly around this time of year the daily death rate is about 1200 people (all causes). In the depths of winter that goes up to over 2000 a day and in the summer it falls to under 1000. (The average across the year is around 1700 per day, but of course that varies a lot depending on the season)

Even 100 people a day dying with C19 is small potatoes at this time of year, especially as a good proportion of them would have died from something else anyway.

Remember again, these deaths are WITH C19, not necessarily FROM C19 and indeed the daily death figures are running along at exactly what we would expect for this time of year, no massive increase at all.

Your argument is based on a false premise.

Not many people have died because of the huge efforts to reduce the R rate.

I agree the current restrictions are a failure of policy, they have been put in place because of a lack of a working test and trace programme.

artie

Sawdust manufacturer.

But there is no test for covid 19Your argument is based on a false premise.

I agree the current restrictions are a failure of policy, they have been put in place because of a lack of a working test and trace programme.

Trainee neophyte

Established Member

In the normal course of events, money is created (magically brought into being) by borrowing it from a bank. It is destroyed by being repaid to the bank. It therefore should be your civic duty to borrow as much money as possible, and never pay it back. In the current regime, who knows what is going on.No seriously, how does the money supply decrease?

I wonder if all that stimulus money and the furlough payments were used to pay mortgages and bank loans, which would destroy the money and be deflationary, which would be A Very Bad Thing. I also wonder if the central banks globally have decided to reign in the QE etc, which will have a pretty immediate and intentional effect on the various stock markets, for their beloved "October suprise". Luckily the people in charge are jolly clever and know exactly what they are doing, so no need to panic.

In answer to your question - I don't know. May be interesting to find out out the mechanism. I shall look further.

Edit: from the same chart source, M1 actually went up by a spooky 6,666 million pounds, whereas M2 and M3 both dropped (by 897 and 19,665 GBP respectively). Does this mean that people have been converting savings into cash? M1 is cash and deposits only; M2 is M1 plus "near-cash" equivalents, such as savings accounts etc, and M3 is M2 plus even more esoteric stuff (like the bizarre shadow banking system, so who really knows...)

Perhaps the question is actually "What is money"?

Last edited:

RobinBHM

Established Member

Please back up with evidence or redactBut there is no test for covid 19

RobinBHM

Established Member

Very rough figures and I mean very rough, population of 66 million average life expectancy 84 means that 785,714 people die every year which is 2152 and a bit a day. I’ve said almost from the start that we are totally out of proportion on this virus. Maybe the original lockdown had some merit to ease the NHS into this – till we found out what it was all about but the present lockdowns are in my view ridiculous, it should be possible to protect the vulnerable from the worst of this and let the rest of us just get on with it. Ian

How can you say we are out of proportion to this virus?

Deaths from all other causes aren't preventable

With Covid, the R value can be reduced by simple social distancing and infection control measures.

RobinBHM

Established Member

emember again, these deaths are WITH C19, not necessarily FROM C19 and indeed the daily death figures are running along at exactly what we would expect for this time of year, no massive increase at all

Remember again, excess deaths during the first lockdown were in the region of 60,000

In line with the Covid death numbers

And 2

you point that Daily death figures are now running in line with normal deaths rates......well gee that proves the Methods used to keep the R rate down have been working.

Thank you for confirming the Covid strategy is working. Well done.

you point that Daily death figures are now running in line with normal deaths rates......well gee that proves the Methods used to keep the R rate down have been working.

Thank you for confirming the Covid strategy is working. Well done.

Or it shows that anyone who was going to die with C19 has already done so, in which case the measures are pointless as we are not protecting anybody and in fact are harming them more by not building herd immunity when we should be.

RobinBHM

Established Member

Or it shows that anyone who was going to die with C19 has already done so, in which case the measures are pointless as we are not protecting anybody and in fact are harming them more by not building herd immunity when we should be.

Estimates give a figure of 3 million people have had Covid.

Herd immunity requires 60% of population.

in any case, research has not proven the case for herd immunity

"Only about 10% of the global population has antibodies against the infection, and experts don 't know how protective they are or how long the protection lasts"

https://www.weforum.org/agenda/2020/08/herd-immunity-not-enough-to-stop-coronavirus/

If you have any peer approved scientific evidence that proves herd immunity would be successful for Covid, I am sure you would like to share it with us.

- Status

- Not open for further replies.

Similar threads

- Replies

- 20

- Views

- 803